Why do I need to know about it?

Provided you don’t rush in, there are several good reasons for at least experimenting with social trading.

- It saves a lot of research time because retail investors are able to profit from the wisdom of multitudes. Giant investors such as Goldman Sachs employ hundreds of people to scour the world’s financial markets for opportunities.

- It saves money that can be freed up for investment. No individual can hope to run a real-time database such as Trade Ideas without a factory-full of servers.

- Trading is much cheaper than through traditional avenues. As Zecco Trading argues, “there is frankly no longer any justification for a brokerage to charge $10 for a stock trade.” (Zecco recently launched “Wall Street”, a real-time app on Facebook that streams stock quotes and other investor information.)

- It provides a low-cost apprenticeship in investing that can be taken at the individual’s own pace and tastes.

- And it can be fun.

Despite the claims of social trading’s more passionate supporters, it’s not going to replace fee-based investment overnight, or indeed at all. However it’s certainly a force to be reckoned with. As journalist (and financial adviser) Andrew Gluck wrote in Financial Adviser magazine: “The trend is just now in its infancy, but it could mean a sudden, radical shift in the way most investors behave, and its popularity is almost sure to grow over the next decade, just as online brokers revolutionised the way Americans invested in the 1990s.”

Certainly, social trading sites complement the established sources of financial news such as CNBC, Reuters and Bloomberg who may indeed be forced to respond. Social trading got a corporate vote of confidence earlier this year when Dell posted its latest earnings figures on StockTwits, another social trading site, before it released them to mainstream news sources.

How does it work?

Social trading depends entirely on web-based technology developed by a new breed of tech savvy investor such as ZuluTrade’s 37 year-old founder and chief executive Leon Yohai. A serial entrepreneur and part-time futures and equities trader who has established successful companies such as fleamarket.gr, his native country’s first and largest e-auction website, premium text-message business InternetQ, and mobile entertainment site Qmobile (this in the US), he conceived the idea of ZuluTrade as a service for people like himself. Designed from the ground up as a forum for individual (or retail) investors who are too busy to follow the markets on their own, it basically allows them to utilise the wisdom of guru investors.

Launched in 2006, ZuluTrade offers an open environment whereby traders can connect and share their knowledge globally. In return, they receive a broker rebate every time another retail trader uses their expertise. The key element of ZuluTrade’s technology is a proprietary algorithm called ZuluRank that grades traders by measuring their activity in multiple ways. The trades are flashed in milliseconds through secure connections to the brokerage firms.

But other less unconventional firms such as Trade Ideas have also embraced social trading in their own way. Founded in 2002, US-based Trade Ideas takes retail investors far beyond mere forex dealing. Perhaps the most powerful real-time stock scanner anywhere, it delivers real-time information from Nasdaq, Amex, New York Stock Exchange and other physical dealing centres as well as a vast array of other market information.

It provides a ready-made range of real-time investment options. For instance, retail investors and others can pursue contrarian, block-trading or short-trading strategies among many others. There’s even one for “experts only”.

Similarly, a vast community of investors have assembled on social investor site StockTwits to share market insight and advice in a real-time stream on shares, forex, futures and other securities. As with Trade Ideas, ZuluTrade, eToro and others, StockTwit subscribers can follow the strategy of liked-minded investors. One of the most popular of StockTwit’s channels is Suggested Stream that assembles the ideas of hand-picked users considered particularly knowledgeable.

Like other social trading sites, StockTwit enforces strict rules designed to weed out spammers and pumpers (self-seeking advertisers).

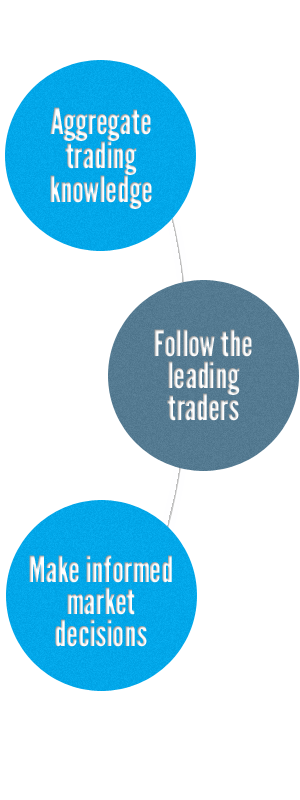

But whatever platform a novice chooses, there are certain principles to observe in retail trading:

- Set limits within which you are the most comfortable. Among other things that’s in terms of the duration of an open position, leverage and risk percentage.

- Look for guru traders – or “trade leaders” – with a strategy compatible with your own. The best traders may have 1,000 or more followers. It’s recommended to follow several gurus on the basis that several eggs in a basket is better than one.

- In forex trading, focus on a few currencies and gain as much familiarity with them as possible.

- Study your guru’s profit and loss curve, preferably over the course of a twelve-month period.

How do I get involved?

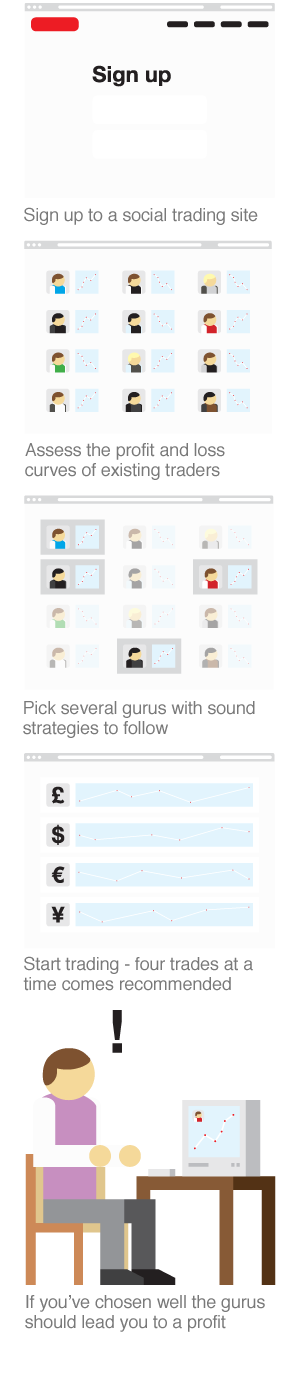

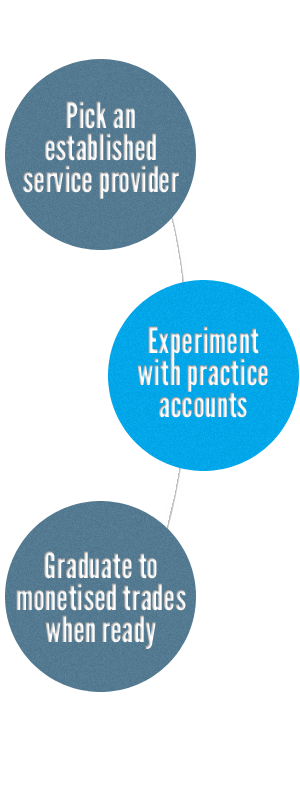

Aspiring social traders don’t have to put on their Sunday best for a formal appointment with a fund manager in an office hung with expensive art. To get started, social trading sites suggest beginners simply register, sometimes for free, sign up for a practice account, also free, with a notional investment pot such as $10,000 and learn the ropes using tools and instruction manuals describing the intricacies of investment. Forex trading is the usual starting point, but this particular universe is expanding. In this way not a cent is at risk.

When investors feel confident enough to use real money, they can dip their toes in the water for as little as $50. Some sites such as eToro set a minimum of $500 if using a wire transfer such as Western Union. Other sites require $2,000 or more. There may also be a bonus system graded to the amount invested. For instance, $10,000 qualifies for a $1,000 bonus on eToro.

Considering which trader to follow, many experienced users would suggest hunting one out with a steady success rate of around 70 percent, as those 100 percent traders come unstuck by definition. On how many trades – and how much money – to risk at any one time, experienced players believe that four is about right. And on profit, many advise aiming for at least 10 pips (€0.70) a trade otherwise “slippage” in the form of fees and other costs can eliminate profit.

On the all-important subject of managing one’s account, one seasoned user says: “Let the SPs [signal providers or, roughly, guru traders] do their work, but you need to monitor your account. Basically this is all about money/risk management.”

“Assuming one account with €100 in it, the minimum investment per trade is €2.50 for one microlot and one pip equals €0.07. To open with a trade with one microlot, I have to ‘pay’ €2.50. So I subtract this amount from the €100 because it is kind of booked for security purposes and I can’t use it for another trade.”

Having done that, he calculates the maximum possible loss of €10.50. “Could I live with that if I lose?” If that looks possible, he might hitch up to another guru trader and follow that strategy for a loss of €21 or 21 percent. “Wouldn’t be pleasant, but you would still be alive with your account,” he concludes.

Some traders like to piggy-back on up to five signal providers but make sure only one or two open a trade at the same time. Simultaneous trading depends on available capital and risk tolerance.

A cautious but positive start is recommended by many experienced social traders, looking for larger lots rather than building a significant numbers of trades.

Who does it?

Social trading is growing as quickly as many social networking sites, with more and more amateur and professional traders signing up, and returning to the trading table, every day.

Some of the field’s leaders include the following:

Case study

World Finance‘s Selwyn Parker signed up for a 30-day ZuluDemo trial and was immediately £10,000 richer.

“I activated the account and start looking for a ‘signal provider’ – that is, an expert to ‘auto-trade’ the demo account. You can select as many signal providers as you like, but you don’t want too many because your €10,000 might quickly evaporate, particularly if the signal provider – an actual trader – is a frequent dealer. That is, in ‘lots’.

“I want guru traders with a strategy compatible with mine, which is conservative. At the very least, I need to preserve my investment pot. So I work my way through traders such as Vipro, Rucom Fic, HighProfitFactor, ConServCap (I like him/her), zhonghua1#, f8, dreams of fx, ANDD, ETE and a few others. I finally find traders with the limits I’m looking for in terms of the duration of their open positions, leverage and risk percentage among other things.

“I particularly like the gurus focusing on a handful of currencies and who seem deeply familiar with them. But this is like forming a relationship because it can take a year or more to become fully au fait with their profit and loss curves, and with their general style and performance. The best traders may have 1,000 or more followers. I want no more than half a dozen, not too few eggs in the basket and not too many. Also, I reason that, the fewer traders I start with, the less confusing the learning process will be.

“You depend on how your chosen signal providers trade your investment pot, but you aren’t helpless either. For instance, I can manage the provider by increasing (if I’m brave) or decreasing (if I’m cautious) the number of “max open lots” to fine-tune my exposure. Thus you can have just one trade open at a time.

“I went for the one trade and I played around with the number of lots per trade that each provider puts up. This has the effect of tweaking the spread and volatility of the trade. Not wanting to be a lamb to the slaughter, I’ve set up a low-risk account. With a pot of €1,000, my minimum investment per trade is €25 for one “microlot”. On this, the maximum possible loss is €100, a reasonable risk. So I decide to invest in another trade with another signal provider. If that comes unstuck, I’ll lose €210.

“Before then though, I check to make sure none of my remaining four gurus have open positions otherwise I could in theory lose on all six, and that’s too big a risk. At this stage my risk tolerance is for €520, or 750 pips in ZuluTrade measure, but I don’t want to lose that all at once.

“The demo account isn’t in real-time, taking 120 minutes for your trading to show up. But ZuluTrade runs a live stream that renders traders naked. You can see them winning and which losing in real time as well as how often and even how much they’ve put up for the trade.

“They’re also graded. A proprietary algorithm called ZuluRank measures traders’ performance.”